RESTRUCTURING & INSOLVENCY

Is value slipping away from you?

Corporate restructuring and insolvency.

Solvent

or Insolvent.

Corporate restructuring involves modifying debt, the operations or structure of a company to improve outcomes for the businesses. All companies continuously need to assess and address their under-performing and/or non-core assets or businesses to maximise/minimise their returns/losses.

Restructuring covers both insolvent and solvent aspects of corporate reorganisation: restructuring can be being carried out for the sake of corporate simplification and administrative improvement and in others where there is an urgent need for an insolvency procedure to be used.

Designing and implementing a reorganisation requires a well-thought-out and carefully structured plan and I have helped more hundreds of companies and groups to conclude a successful exit or reorganisation.

I work with my clients throughout the process, from developing an initial strategy through to detailed planning and hands-on implementation, with the ultimate goal being to free up valuable capital and management time.

Where a business or an investment is facing distress and independent advice is needed on strategic options, potential outcomes and achieving the best result, I provide my clients with the advice necessary to maximise their outcomes.

Insolvency.

The inability to pay your debts as and when they fall due. The law varies between countries on the specifics of what and when insolvency occurs. In general, oftentimes there two tests of insolvency: cash flow and net assets.

The cash flow test is this: are now there or will there in the future be sufficient cash available to meet the ongoing liabilities (creditors) of the business as they fall due. Importantly, this test does also require that the directors of a company consider whether the company will be able to do so in the future (and not just at the present time).

The net asset test is a balance sheet test: do the liabilities of the company exceed the value of the assets. This test has its limitations particularly where the company/project is a start up and is financing is largely by way of debt.

Business or company.

There is a critical distinction to draw between the use of the words: company, and business. A company is a separate legal entity. Business refers to the commercial activities of a company or group of companies.

The business decline curve.

A successful outcomes for any restructuring is highly dependent on the speed of the response by management and/or the owners. While information asymmetry in favour of management (over owners) does constrain the ability of owners to take preventative steps to protect a deteriorating situation, it does not preclude it. Similarly, creditors - secured or unsecured - are also able to take active steps to reduce risk.

I have found it helps clients to consider the business decline curve and the issues that drive the curve and an underlying human factor that often stands in the way of either recognising the situation for what it is - denial. Watch out for those warning signs along the way:

- declining profitability

- liquidity squeeze

- covenants in danger of breach

- worsening gearing ratios

The sooner corrective action is taken the higher the probability of success:

- more options

- better negotiating position

- less trauma

- reduced value destruction

Directors' duties.

One of the core principles in insolvency is to preserve / protect the value - commonly the assets - in a business and realise that value for the benefit of the creditors.

Restrictions often therefore apply to directors of insolvent companies addressing the issues of unfair preference, unlawful / wrongful trading and actions that (attempt to) put the assets beyond the reach of creditors.

Directors who suspect that their company is insolvent or very likely to become insolvent, should take immediate advice from an insolvency expert as the sanctions for breaching the rules / laws can be significant including custodial sentences. And, on the knowledge that the company is insolvent, the director(s) cease having their primary duty of care in favour of shareholders to that of the creditors. During this period, the directors must take active steps to minimise any further losses to the creditors even where that may be to the detriment of the shareholders.

The earlier

action is taken, the greater the likelihood of a successful

restructuring

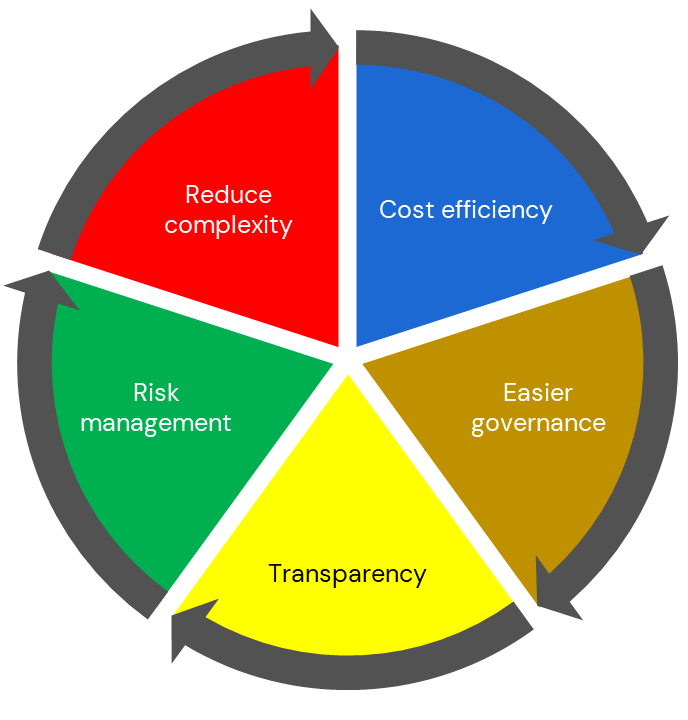

Corporate simplification.

Many corporate groups have companies within their structure that are no longer necessary. Whether these companies are dormant subsidiaries or intermediate holding companies, their removal may be possible and in so doing, bring significant benefits to the group.

Having too layers within a corporate structure can raise the administrative burden, increase operating expenses and result in unnecessary regulatory and reporting requirements (concomitant with their associated costs).

While the process of eliminating the companies requires a commitment from my clients to address the issues raised and management time is required in the short term, the gains from elimination are very quickly seen and longer term benefits realised.

By working with independent tax professionals and my clients, we are able to provide a clear plan to carry out the process in the most efficient manner. And, in simplifying the structure, company groups can enjoy a more efficient corporate structure that is both cost and tax efficient.

Client services.

Corporates.

- Liquidation

- Simplification

- Acquisition / divestment

- Valuation advice

- Mergers

- Refinancing

Management.

- Restructuring planning

- Duties / personal liability

- Analysing strategic options

- Liquidity management

- Stakeholder confidence

- Turnaround planning

Private equity.

- Performance improvement

- Independent review

- Restructuring advice

- Management review

- Workouts

- Exit strategy

Banks.

- Pre-lending reviews

- NPL management

- IBR / ISR

- Sensitivity analysis

- Insolvency planning

- Workouts

Current developments.

The focus of insolvency legislation and procedures has moved from winding up a company towards recovery / rescue of of a business. Implementing business recovery may take many forms: maintain the current corporate structure, sale of the

business

or company

as a going concern, or wind-down and exit.

The shift has been driven by the thought that by providing a company with an opportunity to restructure or compromise its liabilities and continue as a going concern, will preserve employment and stakeholder value.

This has become a common insolvency solution, particularly for companies that are struggling under the burden of debts but are still viable businesses. For creditors, there is an added benefit for them coming from the potential of trading with a customer that is once again viable. However, for any creditor or creditor groups, this renewed trading relationship would need to be balanced against the almost certain losses from a write-down or write-off of old balances.

Moreover, in some instances, there may no longer be a viable ongoing business and the company would need to be brought to an end. And, in this case, a company would then look to sell its assets and, to the extent possible, repay creditors from the proceeds.

The shift to a more debtor-friendly environment for corporate restructuring should be welcomed as an opportunity to develop a more open relationship between all stakeholders. I have operated across multiple jurisdictions and my experiences are that in jurisdictions where the process is not open and restructuring is discouraged, the outcomes for all stakeholders is significantly worse than in those environments where active management of a distressed position is encouraged.